Debt repayment budget template, Budgeting is not a simple job, particularly once you do not have sufficient money to budget at the very first place. A good deal of families and people are actually facing a grave issue of how they will have the ability to make both ends meet, especially today when the prices of almost everything are skyrocketing. Fantastic thing that there are now lots of tools that will have the ability to give you a hand in budgeting, a job which could be frustrating, depressing and dull all at precisely the same time.

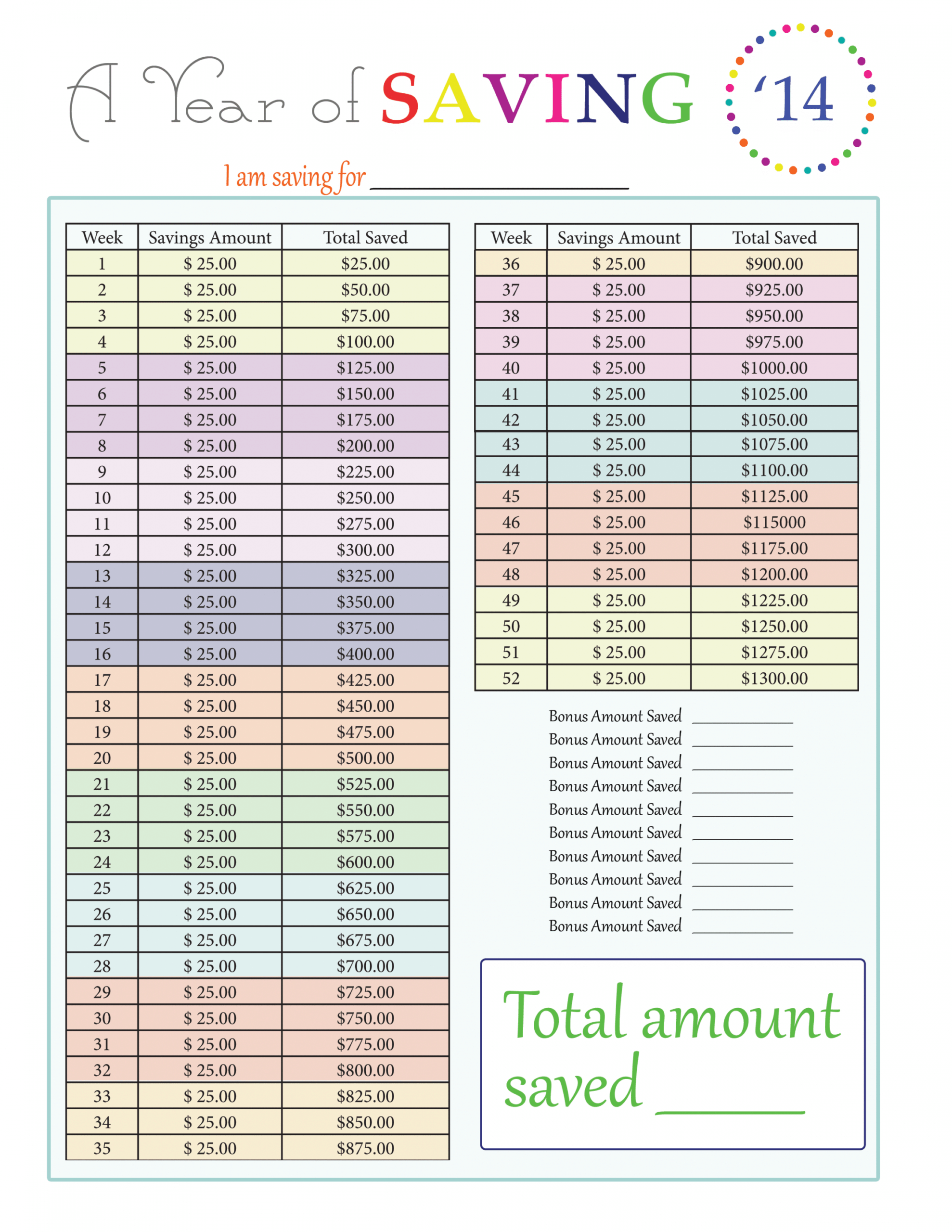

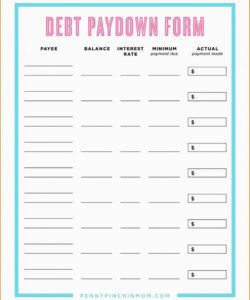

People generally believe that it is vital to make the absolute most out of each and every thing and this is very much applicable even to using the budget template. When there are free budget templates, in addition, there are a lot of additional paid funds templates that have fantastic features, but within this regard, less can be more. In a budget template, you will list down all of the reports which you have and this will surely permit you to get additional savings. The odds of obtaining debts is actually very small since you can easily check the exact money you still have to make it work for your own expenses.

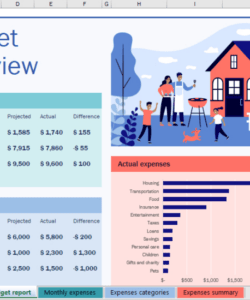

First, you’ll have the ability to understand the current situation of your standing in numeric terms using best budget software/budget template. You’ll have the ability to check if your revenue is in fact covering your expenses along with as well as your other liabilities. These are the things that determine the present results and positions of your financing. With this, you’ll be able to easily predict what may occur in the not too distant future or you can also begin setting your goals depending on the results in the present.

When you are formulating a business budget, be sure to make adjustments for unforeseen expenditure. In the event you are not able to do that, it is possible you will be caught out, and once your budget goes off course you might find it challenging to get it back again. Always include some versatility in almost any budget you produce. It is strange how many folks who have their own companies will be meticulous at home hoping to lower their private debts, for example power bills and support providers, yet when it comes to their company they accept what they’re billed. Try to find the least expensive supplier you can for the communications such as telephone and online services, and use the least expensive power supplier you can find.

Savvy businessmen and people review their budgets frequently, and adjust them to accommodate to the unforeseen. If you find yourself straying from budget find out why and reduce costs elsewhere to compensate. A budget for a small company must be kept – you can not just promise to better next time! They need not be repaired, and so are available to shift, but you must attempt to satisfy the strategies you put yourself in the start of the year or whatever stage you are working to.

If you are also planning to open your own company, you will surely require a little money as capital. And so far as the desired capital is necessary, you need to apply for a certain loan from a lender or lender. Such associations will be more than happy in paying longer based on the skill that you have and they’ll surely be interested in knowing how you’re really handling your finances. Once you’re able to show them that you are good in handling your finances, then you are certainly going to get a approved application.