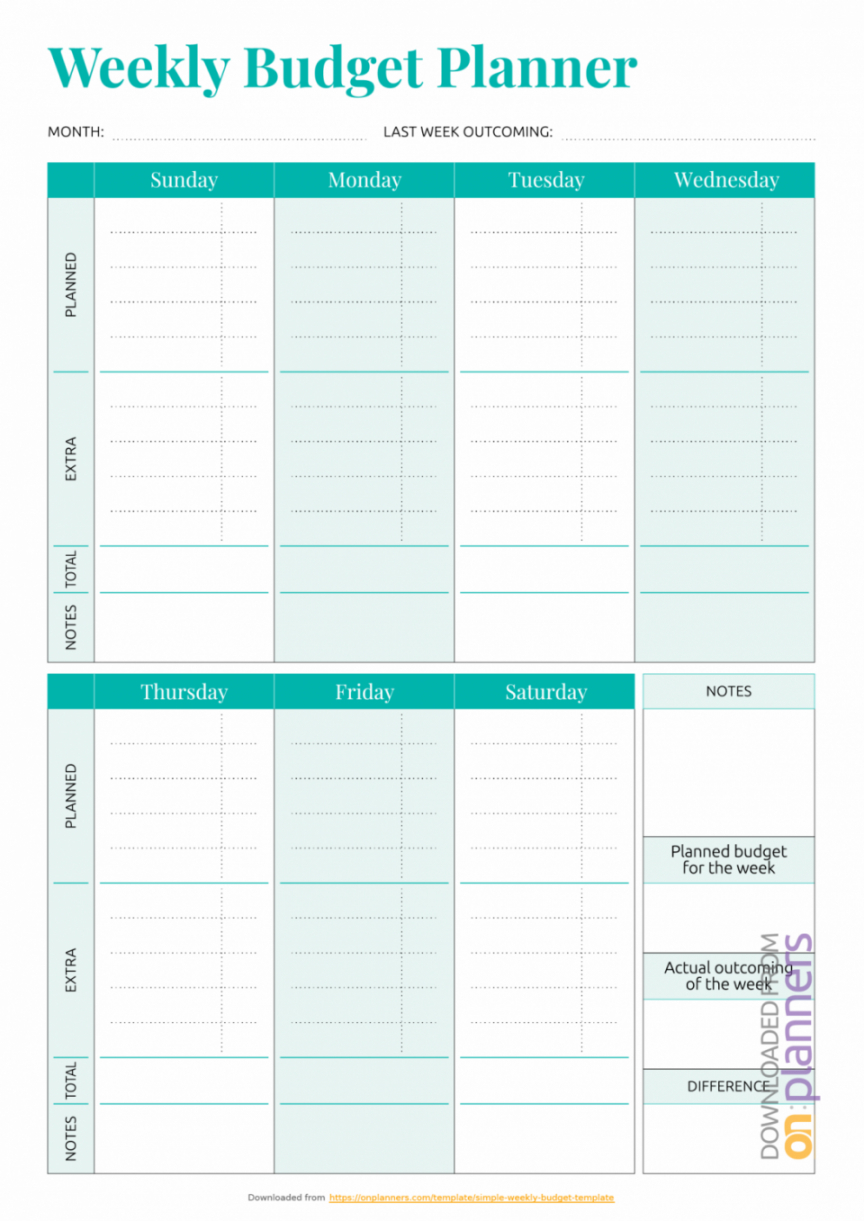

Bi-monthly budget template, Are you constantly trying to stay just 1 step ahead of your bills? A budget can help you arrange your finances. It’s actually surprising, however a funding may save time and a lot of worries. Many people think of a funding as a fiscal jail or a diet. They eventfully fail at their budgeting because of this. You have to think of a budget as simply a way to see where you spend your cash and a plan that helps you get the things you would like.

An essential facet of any company, whether a large multinational company or a one-person home business, would be to continue to keep tabs on where money is being invested and be conscious of why these expenditure was necessary. It’s much less difficult a thing to do since many men and women believe, especially if you pick the right tools to help you, and the cost involved in acquiring it will be saved many times during good fiscal management. In saying that, there are lots of excellent free financial packages available which can assist you with making your financial plan.

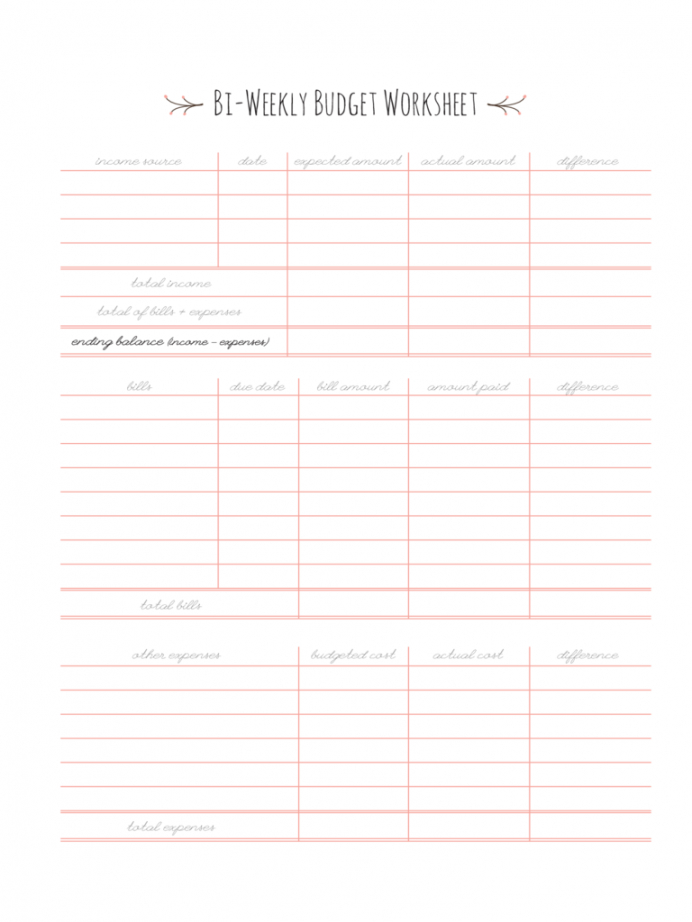

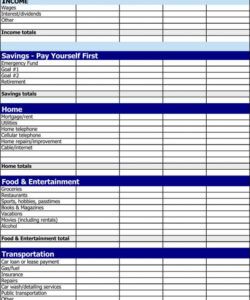

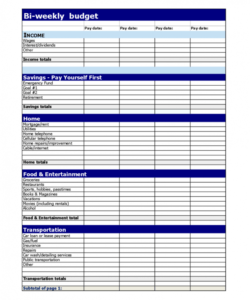

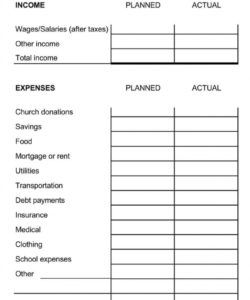

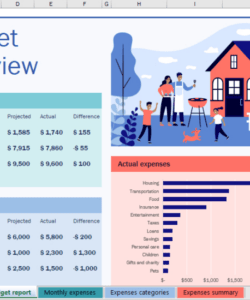

To begin with, you’ll be able to understand the present situation of your own status in numeric terms using finest funding software/budget template. You will have the ability to assess if your income is actually covering your expenses and also as your other liabilities. These are the aspects which determine the present results and rankings of your financing. With this, you will be able to quickly predict what might occur in the near future or you can also begin setting your goals based on the results in the current.

When you’re formulating a company budget, be certain to make allowances for unforeseen expenditure. In the event you are not able to do that, it is possible that you will be caught outside, and once your budget moves off track you might find it difficult to receive it back again. Always include some flexibility in almost any budget you make. It’s strange how many men and women who own their own companies will be meticulous at home trying to cut back their own personal bills, such as power bills and service providers, yet in regards to their business they take what they are charged. Try to get the least expensive provider you can for your communications like phone and internet services, and use the least expensive power provider you can find.

Savvy businessmen and people review their budgets regularly, and adjust them to appeal to the unexpected. If you find yourself straying from funds figure out why and cut costs elsewhere to compensate. A fiscal budget for a small company has to be maintained – you can not just promise yourself to next time! They shouldn’t be repaired, and so are available to change, but you must try to meet the strategies you put yourself at the start of the season or whatever stage you’re working to.

If you’re also planning to start your own company, you will certainly require some money as capital. And as far as the needed capital is required, you should apply for a certain loan from your lender or lender. Such institutions will be happy in paying more based on the ability that you have and they will surely be interested in understanding how you are actually managing your finances. Once you’re able to show them that you are good in handling your finances, you will definitely get an approved application.